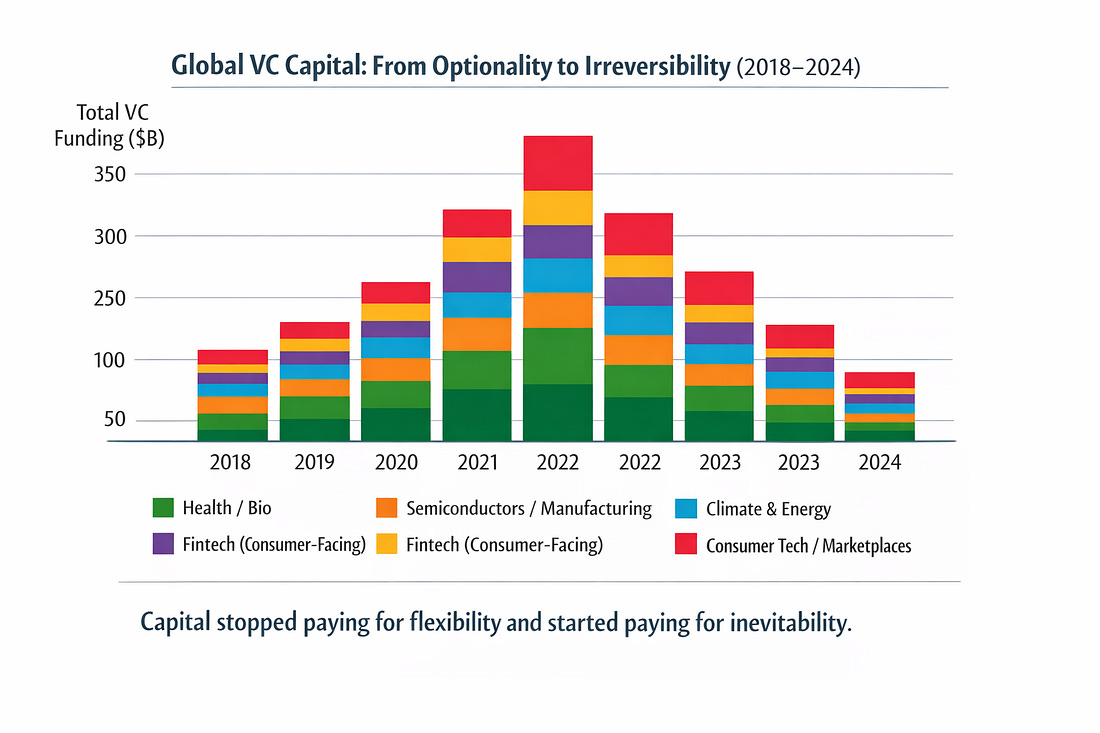

Capital Now Commits Only Where It Can’t Reverse LaterIssue 52 : A Manifesto on why venture capital stopped chasing upside - and started underwriting inevitability.For a long time, Venture Capital optimised for optionality. Low commitment. If something didn’t work, capital moved on. That era is over. This cycle didn’t punish risk. Capital today commits only where backing out later becomes politically, economically, or structurally impossible. This is not a sector story. And once you see it, you can’t unsee it. The hidden rule of the current cycle: irreversibilityBetween 2021 and 2023, global venture funding fell by more than 50%. Most people read this as:

That’s inaccurate. What actually changed was the definition of risk. Risk is no longer:

Risk is now:

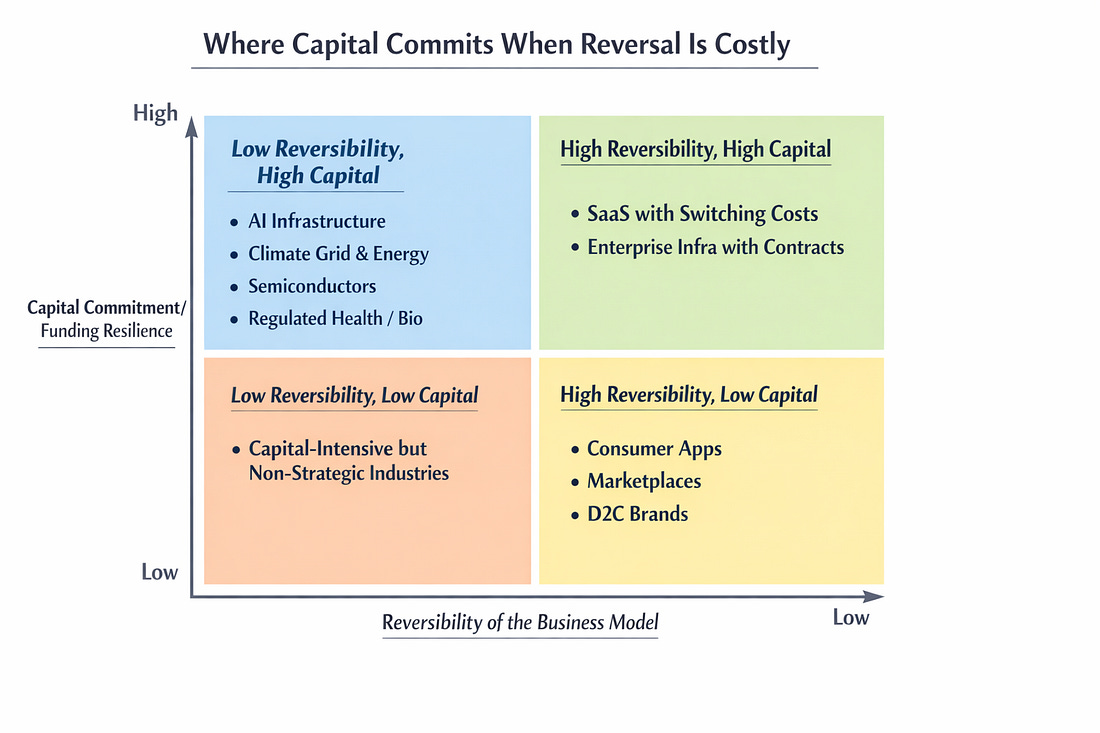

Capital today prefers commitments that:

In other words:

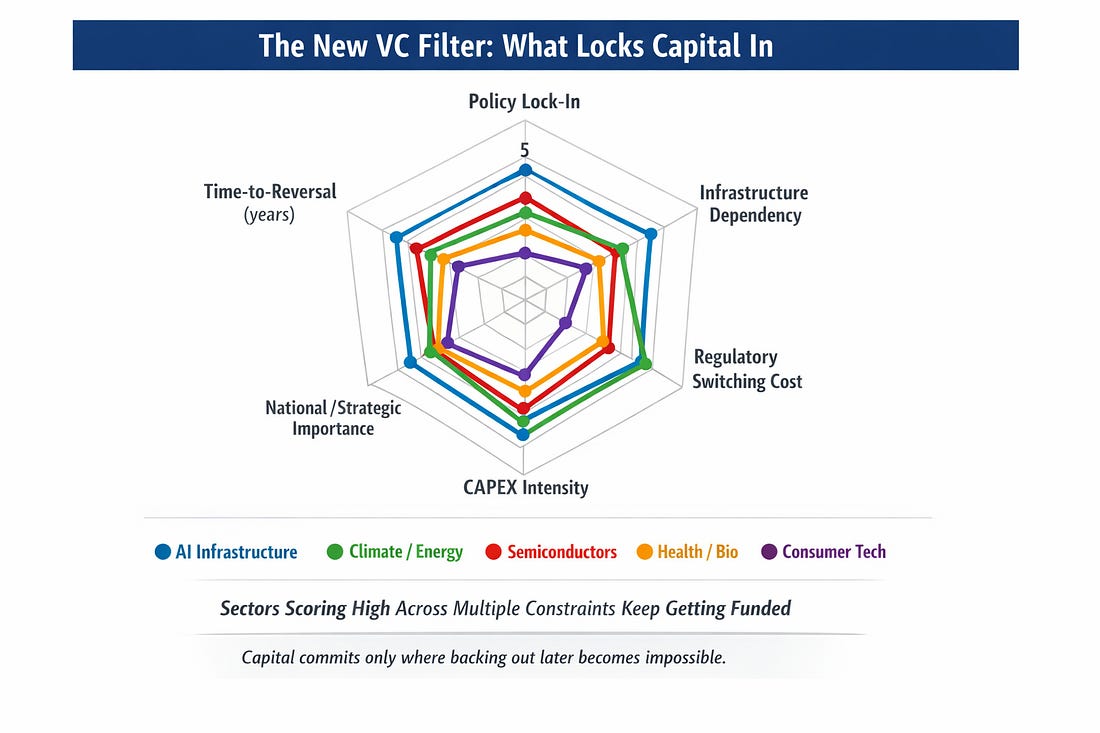

That single shift explains almost every major funding pattern of the last 24 months. Why AI funding didn’t slow - but changed shapeThe headline number is familiar: AI funding crossed $50B globally in 2023, up nearly 10× from 2018. But the composition of that funding matters more than the total. Early consumer AI tools saw compression. Why? Because compute is irreversible. Once:

There is no rollback. This is why capital concentrated into:

Training costs became strategic decisions. Capital wasn’t betting on use cases. Climate tech didn’t survive because it’s virtuous - it survived because it’s locked inClimate tech investment declined only ~7% YoY in 2023, while overall VC fell ~50%. That gap is not ideology. Climate is now:

Once a government commits:

Reversal becomes politically and economically costly. This is why capital stayed in:

The levelized cost of electricity (LCOE) for solar and wind falling below fossil fuels sealed the deal. Capital didn’t fund climate for returns alone. Semiconductors and manufacturing: The return of “Nationally Unavoidable” techFor a decade, hardware was avoided. Then geopolitics intervened. The U.S. CHIPS Act unlocked $52B in subsidies. Once semiconductors became a national security issue, reversibility vanished. Capital followed inevitability. Early-stage semiconductor and tooling deals more than doubled between 2021 and 2023, especially in:

These are not fast-return bets. They are:

Exactly the kind of commitment capital now prefers. Health and Bio didn’t crash - they became non-optionalHealth-tech funding fell ~20% in 2023. That sounds bad until you compare it to the broader market. Capital didn’t abandon health. What survived:

Regulatory acceleration (FDA pathways, rare disease approvals) compressed timelines. Demographics removed optionality. Ageing populations don’t pause. Capital commits where biology guarantees demand. The Unifying pattern founders keep missingAcross AI, climate, manufacturing, and health, the same rule applies: Capital commits where:

This is why capital no longer rewards:

Those are easy to exit. Capital now wants positions it cannot exit without regret. What this means for founders (and why this is uncomfortable)If you’re building today, this changes the bar. You are no longer evaluated on:

You are evaluated on:

That’s a harder question. It also creates sharper winners. Capital Has Already Chosen Its SideThis is not a downcycle. Capital is no longer chasing upside. Founders who understand this will:

Everyone else will keep asking:

It already did. Venture Unlocked — Shubham Bopche Venture Unlocked is free today. But if you enjoyed this post, you can tell Venture Unlocked that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Search This Blog

Wednesday, 11 February 2026

Capital Now Commits Only Where It Can’t Reverse Later

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment